-

Completed

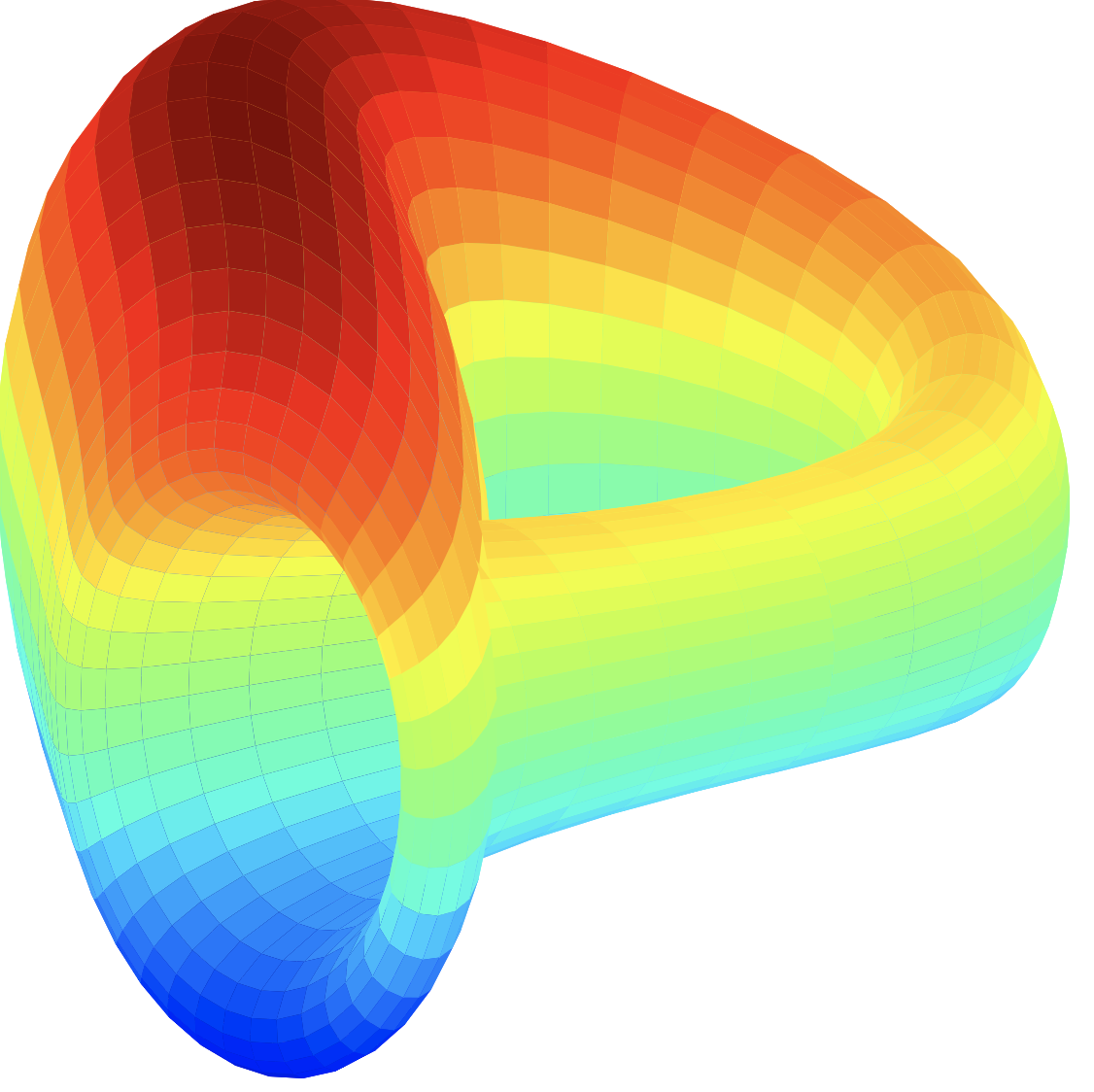

Clique V3 Campaign

As revealed in our 2023 roadmap article, STP is focused on its mission to build an ecosystem optimized for DAOs. We are progressing on our early initiative to build a platform of tools & infrastr

Max Award100

Start Date:

End Date:

-

Completed

Sonet x H.E.R DAO Bounty Event

Join Sonet x H.E.R DAO Blockzone Bounty Event and share a total of 6,500 MATIC

Max Award15 matic

Start Date:

End Date:

-

Completed

Clique DAO Reward Part II

Share $2,000 worth of STPT reward from Clique DAO Reward Part II

Max Award$5

Start Date:

End Date:

-

Completed

Clique DAO Reward

Share $2,000 worth of STPT reward in Clique DAO Reward

Max Award$5

Start Date:

End Date:

-

Completed

DeFine

Share 3,300 USDT rewards in DeFine Airdrop

Max Award$5

Start Date:

End Date:

-

Completed

Sumer.Money

Share a total of 5,000 USDT rewards

Max Award5

Start Date:

End Date:

-

Completed

Soda

Share 4,000 USDT rewards

Max Award5

Start Date:

End Date:

-

Completed

DAD

Participate in DAD airdrop and share 4000 USDT reward

Max Award$5

Start Date:

End Date:

-

Completed

RAI Finance

Participate in the RAI Finance airdrop and share 8,000 USDT token rewards

Max Award$65

Start Date:

End Date:

-

Completed

Deesse

Participate in the airdrop and share $5,000 USDT rewards!

Max Award$5

Start Date:

End Date:

-

Completed

PredictX

Participate in the PredictX airdrop and share $5,000 USDT rewards!

Max Award$5

Start Date:

End Date:

-

Completed

Talken

Participate in the Talken airdrop and share $9,000 airdrop rewards.

Max Award$3

Start Date:

End Date:

-

Completed

DeFine

Participate in the DeFine airdrop and share $5,000 airdrop rewards.

Max Award$10

Start Date:

End Date:

-

Completed

BigBang Core

Participate in the BigBang Core airdrop and share $10,000 worth of BBC token awards!

Max Award$5

Start Date:

End Date:

-

Completed

Lattice

Complete micro tasks for Lattice and share $10,000 worth of the Lattice token prize pool!

Max Award$6

Start Date:

End Date:

-

Completed

Akoin

Participate in the Akoin Airdrop and share $25,000 worth of awards

Max Award$10

Start Date:

End Date:

-

Completed

Klaytn

Participate in the Klaytn Airdrop and share $10,000 worth of KLAY token awards

Max Award$2

Start Date:

End Date:

-

Completed

Chromia

Complete micro tasks for Chromia and win $5,000 CHR token awards!

Max Award$11

Start Date:

End Date:

-

Completed

APM Coin

Participate in the Airdrop to win free APM Token!

Max Award$20

Start Date:

End Date: